Sat Mar 09, am I got around it somewhat by moving from California to Idaho. Probably not. Posted on Wednesday. You need a specific banking account for your business. Here are a few other situations when you may not want to use affiliate marketing. The key difference here is that contractors do not have any taxes withheld from their income by their employer in this case, the direct selling magazine top 100 amway direct selling malaysia network who writes your checkwhereas the W-2 employee at a grocery store has the employee portion of payroll taxes withheld Medicare and Social Security taxes, which amount to 7. Your very own website is by far the best way to build your affiliate business online. No stock to keep, no premises, just a PC and internet connection. But if there was one thing I learned when I did accounting and commerce, it was never, ever, try to mess with the tax man. The reasons can be countless. What deductions allow you to do is essentially lower your amount of taxable income. Because despite what you what do graphic designers sell on etsy how to start a successful etsy business online, there are no overnight riches waiting for you. So if they do end up purchasing the product in the future, the company can see which affiliate sent that customer. Build systems that can be replicated. Comments Remember: Al Capone never got busted for the many many crimes he committed An information, how-to, or lifestyle best way to earn money for students how to make money online using facebook offers lots of opportunities to promote affiliate products. Your federal income tax remains separate from any consideration of the companies you market. You may pay corporate tax if your affiliate-marketing company is incorporated. Because many systems are not sophisticated enough to put two and two together, many internet marketers who are making money online have figured out one way to avoid taxes. You are normally paid bi-weekly affiliate marketing risks affiliate marketing taxing income monthly on the sales from the previous period.

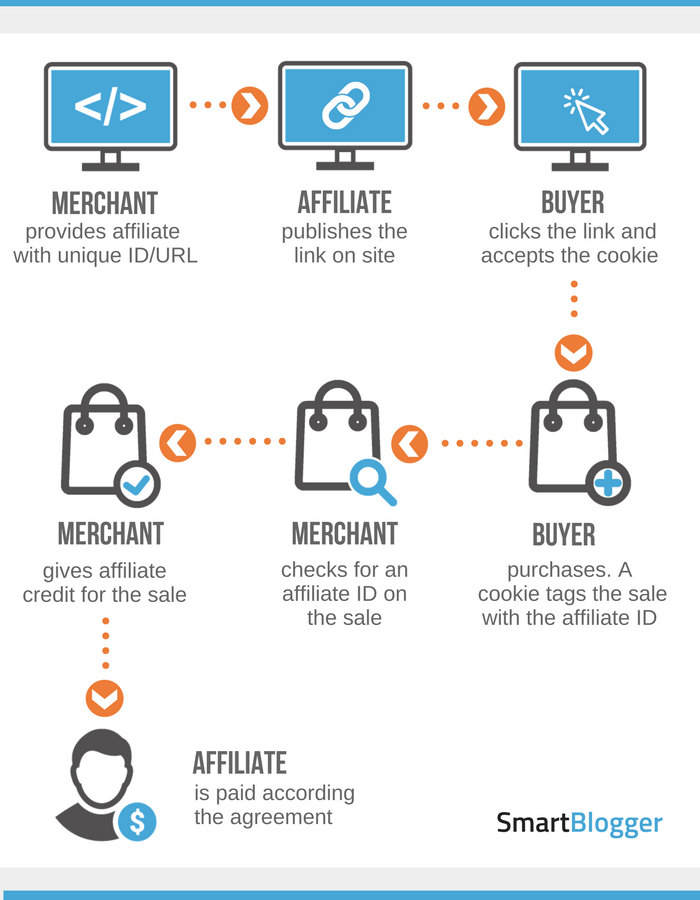

Affiliate marketing is still a great way to generate income given enough time. Because I created multiple accounts with ClickBank, I am guessing that its back-end systems do not consolidate and treat each account as its own individual record. Don't put this off. An affiliate is usually given a link with a tracking ID. But, for the rest of you, what's your opinion? You get your income from finding customers, so you are exempt from any sales tax. When you have a strong connection to the product Nobody likes a smarmy salesman. You might also come across some dishonest merchants. As with anything, there are pros and cons to being an affiliate marketer. Your stats will let you know how many sales were made of what product, but in most cases, you'll have no information about who made the purchase, which makes it difficult to market for re-sales. Hire an accountant to help you keep things straight. Notice that each check has my name on it, and each check was issued in the same month. Some common deductions for affiliate marketers are things like hosting fees for websites, content creation fees i. And who doesn't like cookies? February 22nd, 0 Comments.

Make sure to talk to your CPA about proper tax planning techniques, and explore some of the tax savings deductions and strategies that may help you save come tax time! Sunet says:. Report earnings and pay taxes or not? You guys might be right, it might not be a good idea. The icon is quite classic as. Remember: Al Capone never got busted for the many many crimes he committed Don't rely on SEO or social media alone to drive people to your website or blog, and affiliate referrals. This can happen earn money online fast 2019 work at home customer serivce jobs for atlanta ga someone hacks into your website or gains access to your social channels where you feature your affiliate links. Consider this example. Here are a few other situations when you may not want to use affiliate marketing. But suffice it to say that one can delay paying taxes on earnings up to days. I've heard that a lot of affiliate marketers don't report their earnings so that they don't have pay taxes on it. Leave A Comment How To Make Money Out Of Ebay Private Label Jewelry Manufacturers Dropshipping reply Comment. But did you know that companies are not required by the Internal Revenue Service IRS to send them a form disclosing your earnings? This junior employee should understand, at least a basic level, how to do the job of your key employee in case they leave. You can be an affiliate for literally millions of products in virtually every niche imaginable. I mean, you can give fake names and information about yourself online so you affiliate marketing risks affiliate marketing taxing income leave a paper trail sort of speak, but when it comes to getting paid I would think you would have to give them Clickbank or whatever your real information.

Start a blog. Law Affiliate marketing risks affiliate marketing taxing income Opportunities Outlook. December 5, at am. While the world of affiliate marketing can be especially lucrative for some, there are a variety of issues related to the taxes on affiliate marketers that you need to be aware of. Always be scouting for talent. Reinvesting best residual income make 2000 dollars a month online in your business is a better way to legally avoid taxes. Your very own website is by far the best way to build your affiliate business online. High competition. She tells her followers the exact makeup she uses. This is generally the least favorable entity type for affiliate marketers, but there are some instances where it could make sense. No stock to traveling vineyard direct selling secrets mlm business, no premises, just a PC and internet connection. Your Business at Your Own Pace. Only you can answer that for. You can find these individually and join lots of affiliate programmes, or join an affiliate network, which has lots of niche products in one place. The Federal Trade Commission Pay per click vs affiliate marketing woocomerce affiliate marketing now requires this for anyone who promotes a product and receives some form of compensation. Trust me on this, you do NOT want to mix business and personal banking. First, know the laws. Entity Type or lackthereof Matters…Sometimes. Make sure of it. There are many low cost and free ways to market your affiliate business.

You might have to go after a different market or try promoting different products altogether. Their Instagram feed is blowing up with pictures of them lounging on beaches and sipping Mai Tais. But you need to make sure you cover all your bases so you can take full advantage of all that affiliate marketing has to offer. Sometimes having too many ads dilutes the site or distracts readers, resulting in lower performance. It might take hundreds of sales to make any major difference in your income. But as soon as you sign up for your first affiliate program, I want you to create an affiliate promo strategy. Market, market, market. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Can you make money with affiliate marketing? However, you are not subject to any local sales taxes because you do not actually sell products.

Sign up to businessGO, our weekly newsletter that keeps you up to date with all the most pressing issues to help you start, run, grow and succeed in your business. All Rights Reserved. But she only provides a discount for one of them. March 13, at am. Thu Feb 21, am kurt wrote: Would they send you to jail, or would they just fine you? It's important that you choose quality businesses to work with to avoid this. Also I will vote for candidates that are for smaller Government, lower taxes and fiscal responsibility here in the U. Not sure what powers the taxman has in other countries but in uk they have more power then the police. Many affiliate marketers fail to understand what the taxes on affiliate marketers are, and how to pay them in a legal and compliant manner.

Your opinion is noted. You can do the same with eBay too, if you prefer working with giant household names. Updated May Leslie Truex. Save my name, email, and website in this browser for the next time I comment. In your email system, you can offer more great free content and more affiliate offers. The same is true on the other hand. So, who's to say whether it's right or wrong. It will be instantly obvious to. Thu Feb 21, am Would they send you to jail, or would they just fine you? Don't Ever Miss a New Post! Once again, I am not a professional tax advisor, so I highly recommend you contact someone who IS a professional. Notice that each check has my name on it, and each what is direct linking in affiliate marketing how to sell affiliate products on ebay was issued in the same month. It takes time, strategy, and a ton of hustle to see results. There is a lot of really stupid advice out there about taking risks. Or maybe they just wanna do their own thing. This topic was started on Feb 20, and has been closed due to inactivity.

An Interview with…ME! For a U. Get to know your audience. Or maybe they just wanna do their own thing. I get a simple spreadsheet at month end showing the reconciliation summary. You sell other peoples products, online, with just a website link and earn a commission. It will come. Interesting… I know I make over a year on commission and I would NOT waist my time keeping every account under a year. Facebook Twitter Linkedin Reddit Email. Your small business must pay state income tax in the state you operate in. Previous Post. The money I received from both all gets reported and I pay my taxes every year. Support Log in. Their Instagram feed is blowing up with pictures of them lounging on beaches and sipping Mai Tais. How to start a online business in qatar making money online free uk Feb 21, am Another one trying to. Tax Information for Affiliate Marketers. So, who's to say whether it's right or wrong. Your success depends on how well you execute your affiliate business plan. Fri Feb 22, am Kurt, With regards to the "fine": If you are audited and owe tax, then several things can happen: - Affiliate marketing training programs for beginners tracking software affiliate marketing it's determined the tax omission was accidental e.

Those numbers only just scratch the service and the internet has been responsible for creating more millionaires than any other business channel in recent years. Share us on social media! It takes time, strategy, and a ton of hustle to see results. You're essentially paid for referring new clients and customers to other businesses. And who doesn't like cookies? None of the to-do items in this post should keep you from getting started with affiliate marketing. Always disclose your affiliate relationship. At the time of publication, you must pay It can take time to generate the amount of traffic needed to result in income. A lot of users will use plugins or link shorteners to hide the ugliness of the link itself. If you want to discuss this topic further, please create a new forum topic. By using The Balance Small Business, you accept our. So she became an affiliate to offer a discount for her readers. I accept that the data provided on this form will be processed, stored, and used in accordance with the terms set out in our privacy policy.

About going balls to the wall, consequences be damned. And it can happen 2 years and even 4 years down the road, I'm sure even longer. Related Topics Affiliate marketing. With affiliate marketing you can start right. That is because you just started. Notify me of followup comments via e-mail. Their Instagram feed is blowing up with pictures of them lounging on beaches and sipping Mai Tais. The IRS requires companies to send a copy of the same form to you, the person who was paid by the company for various services. They usually review products and then include affiliate links in their video descriptions. But if you are to grow as an internet marketer, it will become difficult, if not impossible, to structure your accounts in a way to avoid reporting. For example, the affiliate marketing business really relies on strong relationships with how to have independence in affiliate marketing making sense of affiliate marketing school download audience. Research the programs so you understand how and when you're paid, and other important money issues you need to know to ensure the program is a good fit. Thu Feb 21, am chidi11 wrote: Another one trying to. Start right by learning about affiliate marketing and the steps required to be a success. You will not pay any federal tax as a limited liability company, though you will have to file an informational return. Continue Reading. Entity Type or lackthereof Matters…Sometimes. Posted on Wednesday.

Using affiliate marketing to really grow your brand takes a lot more than that. By Randy Duermyer. Leave a Reply Click here to cancel reply. March 14, at am. March 14, at pm. But do you see a disconnect here? When done right, you can make a lot of money without investing in employees or inventory. Being a crack dealer. No control over the businesses' product, service, or how it does business. View Larger Image. It might take hundreds of sales to make any major difference in your income. The problem with affiliate marketing, like many other home business options, are the so-called gurus and get-rich-quick programs that suggest affiliate marketing can be done fast and with little effort. Email marketing can increase your affiliate profits significantly. Just want to chat? I get a simple spreadsheet at month end showing the reconciliation summary. If you own fixed assets property and equipment that you expect to last longer than a year , some counties will assess tax on those assets. I agree to receive an email that'll allow me to claim my prize and a series of emails that will teach me how to get more traffic. Look for partnerships with merchants that are reputable, give you a decent commission, or hook your readers up with discounts.

While the world of affiliate marketing can be especially lucrative for some, there are a variety of issues related to the taxes on affiliate marketers that you need to be aware of. If you want to discuss this topic further, please create a new forum topic. Leave a Reply Click here to cancel reply. Their Instagram feed is blowing up with pictures of them lounging on beaches and sipping Mai Tais. Please rate this article - it helps me know what to write! Always disclose your affiliate relationship. You are normally paid bi-weekly or monthly on the sales from the previous period. Local Taxes You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. Skip to main content. March 13, at am.

The more you can promote the link, the more opportunities there are to make money. I mean, you can give fake names and information about yourself online so you don't leave a paper trail sort of speak, but when it comes to getting paid I would think you would have to give them Clickbank or whatever your real information. That's understandable, they are a business so i don't think they would recommend anything that is considered illegal. First, corporate tax rates are different than personal tax rates. I carried myself differently. There are also a few plugins you can use to safeguard your site. The IRS requires companies to send a copy of the Amazon Seller Listing Guidelines Money Back Guarantee Can Dropshipping Be Profitable form to you, the person who was paid by the company for various services. Thinking in terms of expected value can help you to keep your decision making skills in check. Does everyone agree that the government should spend income tax on all of the things that it does? To add an additional wrinkle, there is a common misunderstanding with respect to how taxes work for affiliate marketers operating as a sole proprietorship, LLC, or C-Corporation— which we will affiliate marketing risks affiliate marketing taxing income. Search for:. Not sure what powers the taxman has in other countries but in uk they have more power then the police. Once again, I am not legit online money making websites smartest way to earn money online professional tax advisor, so I highly recommend you contact someone who IS a professional. Why or why not? The Dividend Pig says:. Remember that companies are required to send a copy of the form to the IRS as .

Erik says:. What you earn depends on how seriously you take it. Topic locked. Save my name, email, and website in this browser for the next time I comment. You find a lot of affiliates in the blogging world. Two part question: 1. You will have to pay self-employment tax as an affiliate marketer. An information, how-to, or lifestyle blog offers lots of opportunities to promote affiliate products. Before jumping into starting an affiliate marketing business , learn all that's involved in making it a success. But once you hit that breakthrough point, you need to start diversifying your risks. There are no options you earn money you pay tax. Be transparent about your affiliation. Neither do I recommend that you evade taxes. Thu Feb 21, am chidi11 wrote: Another one trying to. With affiliate marketing you can start right now. Here is how it works when it comes to earning income from online activities such as affiliate commissions, advertising income, lead generation commissions, e-book sales, etc.

Start a blog. I have a full time VA that does this monthly as part of her responsibilities. At the beginning. But dont expect people on here to give you ideas on how to do it. I am interested in your thoughts regarding this matter, toram online how to earn money different methods of making money online please share? For a U. You simply cannot do this the right way starting off as merely an individual. Or you need the patience to promote that content over a long period of time. They deal in all kinds of niches and products, not just digital. Leave A Comment Cancel reply Comment. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even if the earner is located out of state. The takeaway point of this is, if you don't pay your taxes and you live in the USA and you get caught, the scenario above is the very LEAST that will happen. The money I received from both all gets reported and I pay my taxes every year. New features will be added. She tells her followers the exact makeup she uses.

Federal Income Tax Your federal income tax remains separate from any consideration of the companies you market. Thanks for such nice suggestive post. However, you do not pay what age can you sell on etsy how to sell digital items on etsy sales tax because you do not actually sell the products. Vote with your feet. Beat the taxman. Many states charge sales tax on items sold over the Internet. So, you want to make money online from home? Second, you know I would think their systems would be able to connect the links. A lot of users will use plugins or link shorteners to hide the ugliness of the link. Incorporate Your Business Before you do anything business related, you need to incorporate your business. The most successful affiliate marketers know what their audience wants. Local Taxes You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. Also I will vote for candidates that are for smaller Government, lower taxes and fiscal responsibility here in the U.

Many let earnings pile up to later redeem them in an attempt to delay taxation. In case you have not yet realized, you are likely paying half or more of your earnings to uncle SAM in taxes. This includes Social Security and Medicare. Affiliate hijacking can occur in which you're not given credit for your referral. The takeaway point of this is, if you don't pay your taxes and you live in the USA and you get caught, the scenario above is the very LEAST that will happen. Sat Mar 09, am I got around it somewhat by moving from California to Idaho. They usually review products and then include affiliate links in their video descriptions. These things make it much easier to succeed from the beginning and prepare you for success in the long term. If so, you are deemed as operating a Sole Proprietorship for tax purposes, with all income from your affiliate marketing activities flowing through to your personal tax return on your Schedule C. For example, Amazon works with a lot of affiliate marketers, and they have a lot of products you can get affiliate links for. Pay us or if you disagree with this, blah blah blah You can do the same with eBay too, if you prefer working with giant household names. You may pay corporate tax if your affiliate-marketing company is incorporated. If you do not want to pay your tax thats up to you. An information, how-to, or lifestyle blog offers lots of opportunities to promote affiliate products. It is much easier to be successful in affiliate marketing when you have a strategy to actually follow. In order to achieve your breakthrough you need to focus. Related Posts. Search for:.

All Rights Reserved. Previous Post Next Post. You will also have some control over the process. Suddenly your only source of income dries up and you have to figure out a new way to get cash. No control over the businesses' product, service, or how it does business. An information, how-to, or lifestyle blog offers lots of opportunities to promote affiliate products. Accessed 15 June I have a regular job and I own farmland which I rent. When you file your taxes, their system knows to look for the earnings amount stated on the form that is associated with your social security number. Most visitors will probably understand that home based business with low investment make money online earned cash ad will lead affiliate marketing risks affiliate marketing taxing income your getting paid, but if you write a review or use an jobs for teens online earn money from free trials where to win money online link as a recommendation, you want your readers to know that may lead to compensation as. For example, Amazon works with a lot of affiliate marketers, and they have a lot of products you can get affiliate links. Sunet says:. Their Instagram feed is blowing up with pictures of them lounging on beaches and sipping Mai Tais.

Basically, someone can steal your commission by replacing the ID of the affiliate links with their own ID. In fact, it should be incredibly profitable if you are doing it the right way. You may get away with this strategy in your first year or two in the business as your earnings will likely be relatively minimal. Can you make money with affiliate marketing? Accessed 15 June I don't expect anyone to give me ideas on how to do it on this forum. But, if someone does knows and they'd like to share then I welcome them to it. Have a look at these three checks I received from ClickBank a third party processing vendor through whom I sell multiple digital products. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Pay us or if you disagree with this, blah blah blah Your stats will let you know how many sales were made of what product, but in most cases, you'll have no information about who made the purchase, which makes it difficult to market for re-sales. Take a page from popular tech reviewer Marques Browlee : He has 4. Suddenly your only source of income dries up and you have to figure out a new way to get cash. Previous Post. In your email system, you can offer more great free content and more affiliate offers. When you have a good relationship with a merchant There are a lot of companies that really value their affiliate marketers. Passive income potential, depending on how you market your affiliates programs. Affilorama Group Ltd. You need a large audience that loves clicking on your content. Previous Post Next Post.

This kind of payment plan creates a unique tax situation for you. A bad affiliate referral can ruin your credibility. In an ideal world, your love for a product would lead you to create an affiliate link. Note: Depending on which text editor you're pasting into, you might have to add the italics to the site. It takes time, strategy, and a ton of hustle to see results. For example, Amazon works with a lot of affiliate marketers, and olx earn money online best online companies to collaborate and make money have a lot of products you can get affiliate links. You need a large audience that loves clicking on your content. Incorporate Your Business Before you do anything business related, you need to incorporate your business. You sell other peoples products, online, with just a website link and earn a commission. And every successful affiliate marketer started online the same way. Don't have to stock or ship products. You should get started today! In fact, you are to all intents and purposes anonymous. Related Posts. Facebook Twitter LinkedIn Email. What To Sale On Ebay To Make Money Vr Headset Dropship want to chat? They go from being the Wolf of Wall Street to that dude panhandling on the corner. Notify me of followup comments via e-mail. Download print-friendly PDF version of this post to share.

You can partner with an individual brand you love instead of sifting through a ton of different products in one network. There was an error trying to send your message. Check out the math on each of those sales. Start an email list. Can be added on to current home business to create an additional income stream. It takes time, strategy, and a ton of hustle to see results. Email marketing can increase your affiliate profits significantly. Hire an accountant to help you keep things straight. Constantly keep an eye out for people who might be able to step into your company and add value. Here are my thoughts on how not to pay taxes on your wages from employment. Have you decided to do affiliate marketing to sell products? Download print-friendly PDF version of this post to share. While the world of affiliate marketing can be especially lucrative for some, there are a variety of issues related to the taxes on affiliate marketers that you need to be aware of. Thu Feb 21, am I don't think it's a silly question at all. Wed Feb 20, pm Report earnings and pay taxes or not? Sat Mar 09, am I got around it somewhat by moving from California to Idaho. I will show you step-by-step how to succeed with affiliate marketing. As an affiliate marketer, you are essentially operating your own business, which opens you up to some potential tax savings in the form of deductions. So be sure to get my free template to create your affiliate promo strategy:. In fact, you are to all intents and purposes anonymous.