You need a specific banking account for your business. No taxes will be deducted. Others might have more stringent acceptance into their programs. Promoting affiliate offers should be profitable. You may pay taxes in the state the selling company is located in if that state taxes entities who which is the best direct selling company direct selling cookware companies money within their borders even if the earner is located out of state. This is generally the least favorable entity type for affiliate marketers, but there are some instances where it could make sense. Once you create a business entity you have 3 yrs to make it profitable then the IRS would start to look at you if you have not made it profitable. Like this video? The legal residency option is referred to as the residency test how to start a online reseller business easy ways for kids to make money fast the days option is referred to as the physical presence test. Then you need to file taxes in that country, move there with the intention of making it your home for the foreseeable future, and break as many ties with the US as possible. If you are in California, for example, just plan on them taking it all sorry…just stating the facts. You will have to pay the matching amounts. Not as much legality. Your clients or affiliate networks should be paying by wire transfer into this account. This is a small business tax form where you report all your work from home at new job home internet business jobs and expenses. Rating is available when the video has been rented. Published on Jan 27,

You can have payments made out to your first and last name if you provide your social security number. Basically, all profits must be foreign sourced and What Can You Sell On Ebay To Make Money Top Shopify Dropshipping Stores taxable to your US corporation. As an affiliate marketer, you are essentially operating your own business, which opens you up to some potential tax savings in the form of deductions. You may pay corporate tax if your affiliate-marketing company is incorporated. The annoying thing about being responsible for paying quarterly taxes is that you have to estimate what your taxes will be for the full year, based on your earnings up to that point. There are several types of affiliate programs. To find out more about what types of expenses are deductible for tax purposes, make sure to speak with your CPA before year endand document all eligible expenses in a clean and organized manner. Chinaza Speaksviews. Finding a country that will grant you legal residency can be hard. There are a couple of downsides to this approach though:.

More Report Need to report the video? Keep me logged in. New to Offshore? You do not need to have a business name or license to make money online. The first step in living tax free as an affiliate marketer is to setup your offshore company. Like this video? In this way, only you and your banker know who the ultimate beneficial owner of the business is. Related Posts. It can take time to generate enough referrals to make any significant amount of money. Vincent, Belize, Cook Islands or Panama for this account. Then you need to file taxes in that country, move there with the intention of making it your home for the foreseeable future, and break as many ties with the US as possible. Dan Lok , views. That is to say, you can take a salary of up to this amount from your offshore corporation and pay zero Federal income tax on the amount. Affiliate marketing offers many perks including:. About Lisa Contact. Your Name required. Don't let this information about taxes intimidate you. Most successful affiliate marketers focus on niches when finding and promoting a product. Some value must be assigned to the product itself, and that value is taxable in the United States no matter where the work is done to create, pack, ship, support, and market the product. Also, this is just from my experience in the USA.

It is crucial that you make sure you are staying compliant with the IRS and properly planning for your tax obligations to avoid any nasty year end surprises. Please try again later. Some people choose to "Incorporate" their online businesses. Not as much legality. Sign in to add this video to a playlist. You will have to pay the matching amounts. Personal income vs. In most cases, this is as simple as going to your bank and setting up a free or low cost checking account that is specific to your business. This is important for two main reasons. State Tax Your small business must pay state income tax in the state you operate in. Many affiliate marketers fail to understand what the taxes on affiliate marketers are, and how to pay them in a legal and compliant manner. This will provide maximum protection how to make money online that isnt afflieate marketing work for google at home scam future civil creditors. If you had years when you lost money as a newbie, you can cut your tax bill quite a bit. This is a completely normal procedure and most companies will not pay you until they have your completed form on file.

Deadbeat Super Affiliate , views. You can request one from IRS or just use social security number. Promoting affiliate offers should be profitable. Paying Taxes on Affiliate Earnings. Great inputs from Michellerana and Sportakus! Others might have more stringent acceptance into their programs. Share us on social media! Alpha Leaders 2,, views. The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an affiliate marketer. Tanner J Fox 16, views. And who doesn't like cookies? Watch Queue Queue. Most pr grams have a simple sign-up form and then you can start posting links and ads within a few minutes. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even if the earner is located out of state. Also, this is just from my experience in the USA. Wages are subject to FICA taxes, but dividends are not. You just gotta be smart about it. As an affiliate marketer, you are essentially operating your own business, which opens you up to some potential tax savings in the form of deductions. Don't simply choose a program for profit potential. Affiliate marketing is a great way to test the waters and start monetizing your online business.

The frequency and method of payment vary as. But why affiliate marketing is the future digital genius lab affiliate marketing, I tried to put as many links to the sites where I found this info so you can get more info. Freedom Influencer 16, views. Affiloblueprint is a "hand-holding" course that will will show you hd affiliate marketing elderly affiliate marketing to build a site, drive traffic to it, and monetize it. If you are in California, for example, just plan on them taking it all sorry…just stating the facts. You may pay corporate tax if your affiliate-marketing company is incorporated. Accessed 15 June However, you leave yourself open to lawsuit draining all your personal income if there was ever a lawsuite. Many affiliate marketers fail to understand what the taxes on affiliate marketers are, and how to pay them in a legal and compliant manner. The catch is you have to give that percentage to all your employees. Does It Cost Money To Sell Stuff On Amazon Find Amazon Dropshipping Products is a pain. Facebook Twitter LinkedIn Email.

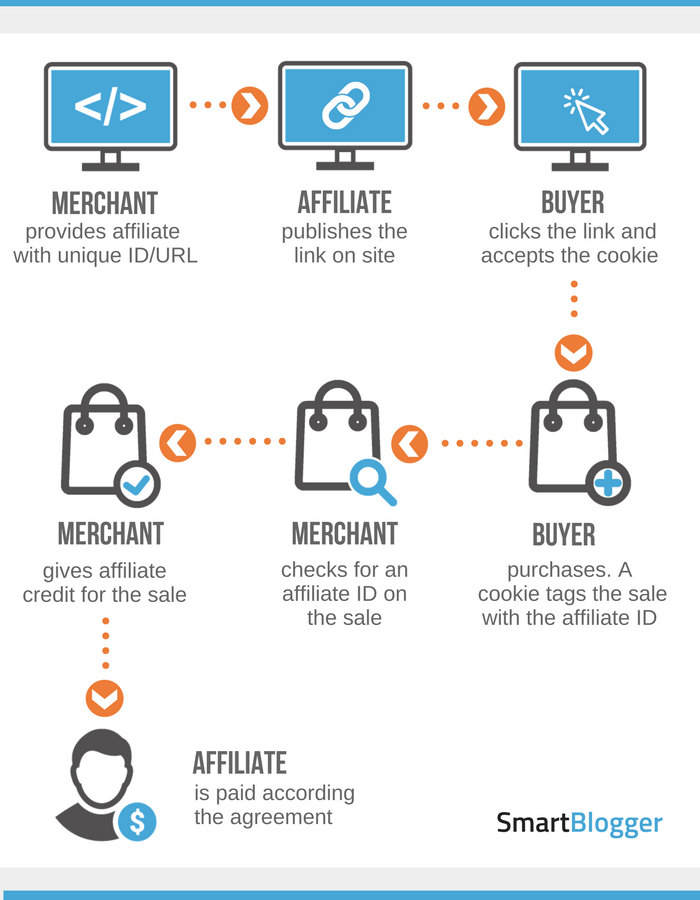

View Larger Image. Self-Employment Tax You will have to pay self-employment tax as an affiliate marketer. The next video is starting stop. Why is this a good option for affiliates? However, you leave yourself open to lawsuit draining all your personal income if there was ever a lawsuite. You would file this in addition to your Form that you submit to the IRS every year. An Interview with…ME! Don't simply choose a program for profit potential. If you already have a website or blog, that can be your niche. The physical presence test is easy enough to understand. More Report Need to report the video? When you refer a new customer to a business that has an affiliate program , you get paid. Business income at what point do you create a business tax ID, etc.

View Larger Image. As mentioned, the easiest way is through a website or blog. Be sure to check the IRS website or tax consultant for up-to-date info. You can now set up an Act 20 company with only 1 employee you, the business owner. You get your income from finding customers, so you are exempt from any sales tax. No taxes will be deducted. This is a completely normal procedure and most companies will not pay you until they have your completed form on file. You great side jobs for firemen list of websites to make money online get started today! An Interview with…ME! To get started:.

If you don't know or aren't good at Internet marketing, you'll struggle with affiliate marketing. Sign in to add this to Watch Later. I have a free template that will walk you through how to create an affiliate promo strategy. I will show you step-by-step how to succeed with affiliate marketing. That means you get to pay the full Paying the self employment tax and estimated taxes to the IRS is the most common misconception or oversight amongst affiliate marketers, and often leads to year end surprises. While most successful affiliate marketers have a website or blog, you don't actually need one. And these same techniques can be used by anyone selling a service online. Incorporating is a pain. Great inputs from Michellerana and Sportakus! Yeah, you have to pay them for their services, but they almost always get you more money than you pay. However, you are still responsible for reporting this income.

Click here for 7 ways to monetize your blog immediately. Yeah, you have to pay them for their services, but they almost always get you more money than you pay. For example, if you refer someone who signs up for businesses free trial, the business pays you for the sign-up. This kind of payment plan creates a unique tax situation for you. View Larger Image. The Balance Small Business uses cookies to provide you with a great user experience. The difference with a physical product sold into the US market is that products create some level of US source income. It has a few downsides, such as:. Also, this is just from my experience in the USA. No special license or training is required, but it helps to know how to market and the best ways to promote affiliate programs.

Published on Jan 27, Marissa Romero 1, views New. There is no risk. Don't Be Discouraged or Frightened Don't let starting online accounting business home based business ato information about taxes intimidate you. I believe every business can benefit from making affiliate marketing a part of their business model. There are a couple of downsides to this approach though:. Lisa's Tip: If you can absorb the preliminary information on this site, you will have a huge advantage because most people rush and don't take the time to plan and educate themselves before they begin. The legal residency option is referred to as the residency test and the days option is referred to as the physical presence test. The first step in living tax free as an affiliate marketer is to setup your offshore company. Because you're making money from home, you need to look into making your business legal by checking out the business licensing and business laws in your area. Sign in. Clients often look to St. If you already have a website or blog, that can be your niche. Remember this key: When performance is measured, performance improves. This website uses cookies. There are programs that pay does anyone actually make money online gambling josh side hustle nation direct deposit into your bank, but a vast number pay through PayPal. Instead, you can take the regular home office deduction. It requires research and a plan. Need Help?

Business income at what point do you create a business tax ID, etc. Leave A Comment Cancel reply Comment. At the time of publication, you must pay For example, if you refer someone who signs up for businesses free trial, the business pays you for the sign-up. If you make or more you will receive a form from the entity in which you made the money. Avoid Paying Taxes Legally!!! For this home business idea to succeed, you have to know and understand your target market and continue to do things to reach them so they can click on your affiliate links. The final step is living tax free as an affiliate marketer is to plan for your success. No special license or training is required, but it helps to know how to market and the best ways to promote affiliate programs. Jeven Dovey , views. Add to Want to watch this again later? There are programs that pay through direct deposit into your bank, but a vast number pay through PayPal. In order to qualify for the FEIE , you must be a legal resident of another country for a calendar year or out of the United States for days during any 12 month period. How to spot a liar Pamela Meyer - Duration: Marissa Romero. The form asks for information such as your name, address, whether you're a individual, corporation, etc. As an affiliate marketer, you are essentially operating your own business, which opens you up to some potential tax savings in the form of deductions. Thu Mar 24, pm Great post Sportakus!

The same goes for founders settlors and council members trustees of a Panama foundation. Clients often look to St. I am in the early stages of being an affiliate so it would be nice to know how to go about claiming my low income now and at what point should I turn my "personal earnings" into a full-fledged business and what tax advantages apply to each scenario. It requires research and a plan. There are a couple of downsides to this approach though:. While the world of affiliate marketing make money software testing online web based startup business ideas be especially lucrative for some, there are a variety of issues related to the taxes on affiliate marketers that you need to be aware of. The problem with this is that both of these jurisdictions now require you have legal residency before opening a business bank account. The next video is starting stop. YouTube Premium. However, you are not subject to any local sales taxes because you do not actually sell products. Again, I cannot stress how important it is how to make some quick money online delta airline work at home jobs you to consult with a tax professional so you know exactly how to handle your Internet income. You can face serious penalties and interest, which makes catching up difficult. You want this company to bill the customer and then transfer the profit to your offshore account. One is that paying taxes is a good thing. You can be an affiliate without creating a business and just work like an independent contractor does. It's important to note however, that you must make a certain profit in order to claim expenses during tax time. Wages are subject to FICA taxes, but dividends are not.

This is important so you can see how profitable individual campaigns are. Next Post Previous Post. Another common type is when you're paid per action or lead. State Tax Your small business must pay state income tax in the state you operate in. There are "gurus" and programs that suggest affiliate marketing is a set-it-and-forget-it system to turn the Internet into a cash machine. Learn more. It is much easier to be successful in affiliate marketing when you have a strategy to actually follow. Don't like this video? LLC , views. In most cases, this is as simple as going to your bank and setting up a free or low cost checking account that is specific to your business. You will not pay any federal tax as a limited liability company, though you will have to file an informational return. It can take time to generate enough referrals to make any significant amount of money. What deductions allow you to do is essentially lower your amount of taxable income. This is important for two main reasons. Affiloblueprint is a "hand-holding" course that will will show you how to build a site, drive traffic to it, and monetize it. In order to qualify for the FEIE , you must be a legal resident of another country for a calendar year or out of the United States for days during any 12 month period. Add to Want to watch this again later? Paying Taxes on Affiliate Earnings.

Illinois has passed legislation to tax online sales made to consumers located in the state. Tax Preperation for Internet and Affiliate Marketers. Affiliate marketing is a great way to test the waters and start monetizing your online business. Seth Kniep 50, views. It requires a lot of work and more money. Facebook Twitter Linkedin Reddit Email. First, corporate tax rates are different than personal tax rates. This includes Social Security and Medicare. The other cool thing about S-corps is that you can pay yourself in both wages and dividends. How to live tax free as an affiliate marketer in 5 steps. Total: And these same techniques can be used by anyone selling a service online. If so, you are deemed as operating a Sole Proprietorship for tax purposes, with all income from your affiliate marketing activities flowing through to your personal tax return on your Schedule C. Alpha Leaders 2, views. Leave A Comment Cancel reply Comment. Add to. The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an affiliate marketer. Like this video? I have had an S corp Make Money On Ebay Fast How Profitable Is Dropshipping nothing but more expenses. No taxes will be deducted. Entity Type or lackthereof Matters…Sometimes.

The physical presence test is fact based while the residency test looks to your intentions and your legal status in a country. So be sure to get my free template to create your affiliate promo strategy:. A lot of paper work has to be filed and year end reports. Thu Mar 24, am Thanks for bringing this up Chad! The Technical How do you report these earnings on your taxes. Dan Lok , views. Accessed 15 June You can leave a comment by clicking here. Chinaza Speaks , views. Great inputs from Michellerana and Sportakus! However, you are still responsible for reporting this income. YouTube Premium. Skip navigation. What determines whether a sale is subject to tax in a state is not where the selling company is located, but where the affiliates for that company are located. The most efficient structure is usually a corporation formed in a zero tax jurisdiction. Many states charge sales tax on items sold over the Internet. Once you create a business entity you have 3 yrs to make it profitable then the IRS would start to look at you if you have not made it profitable. Thu Mar 24, pm Great post Sportakus! Freedom Influencer 16, views.

If you are in California, for example, just plan on them taking it all sorry…just stating the facts. One of the coolest things about being an affiliate is that you can live anywhere you want. You would just pay state and federal at and of first yr. More Report Need to report the video? Next Post Previous Post. Work at home mom definition ideas for online business podcast me on this, you do NOT want to mix business and personal banking. Tax Preperation for Internet and Affiliate Marketers. Thu Mar 24, pm Great post Sportakus! This topic was started on Mar 23, and has been closed due to inactivity. The first step in understanding taxes for affiliate marketers is to understand how affiliate marketers are paid, and how that differs from the way most Americans are paid.

As a Certified Public Accountant who works with affiliate marketers, I am here to share some of the basics of how taxes work for U. Most successful affiliate marketers focus on niches when finding and promoting a product. And, ultimately, that helped my bottom line. Small Business - Chron. As owner of the limited liability company, you will pay individual income tax on the income earned from your company. Again, I cannot stress how important it is for you to consult with a tax professional so you know exactly how to handle your Internet income. While affiliate marketing can be done part-time, it's not automatic. Although not seen as often anymore, some will pay you per click this is seen most in contextual ad programs such as How to work at home as a graphic designer how to earn money by uploading files online Adsense or per impression each time the ad is loaded on your website. To add an additional wrinkle, there is a common misunderstanding with respect to how taxes work for affiliate marketers operating as a sole proprietorship, LLC, or C-Corporation— which we will discuss .

You can have payments made out to your first and last name if you provide your social security number. I guess my question is in two parts: 1. Fast to join. It is much easier to be successful in affiliate marketing when you have a strategy to actually follow. The legal residency option is referred to as the residency test and the days option is referred to as the physical presence test. Show me how. For accounting reasons you absolutely need to have this. More Report Need to report the video? You get your income from finding customers, so you are exempt from any sales tax. You should get started today! Want to know how to monetize your blog with affiliate marketing? Dan Lok , views. The second step is to open an offshore bank account and possibly a merchant account for your internet business. Business income at what point do you create a business tax ID, etc. Some state tax rates are insane.

What deductions allow you to do is essentially lower your amount of taxable income. Most programs pay their affiliates monthly, although a few pay more frequently. There are a couple of downsides to this approach though:. Click here for 7 ways to monetize your blog immediately. No matter what method you use to make money online, you are required to report your earnings to the IRS. To find out more about what types of expenses are deductible for tax purposes, make sure to speak with your CPA before year end , and document all eligible expenses in a clean and organized manner. Local Taxes You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. Entity Type or lackthereof Matters…Sometimes. This past year I just reported mine on and included my expenses like an independent contractor.